As we head towards the end of the year, the cryptocurrency market is still demanding attention with a lot of exciting activities and surprises. Among these are Shiba Inu (SHIB) and Rexas Finance (RXS), which have recently been recognised by investors as possessing the potential to record strong growth in a short period. Owing to their robust infrastructure and great recent results, the debate about investing in these assets now has even intensified. Is now still a good time to buy?

Shiba Inu (SHIB): Riding a wave of momentum

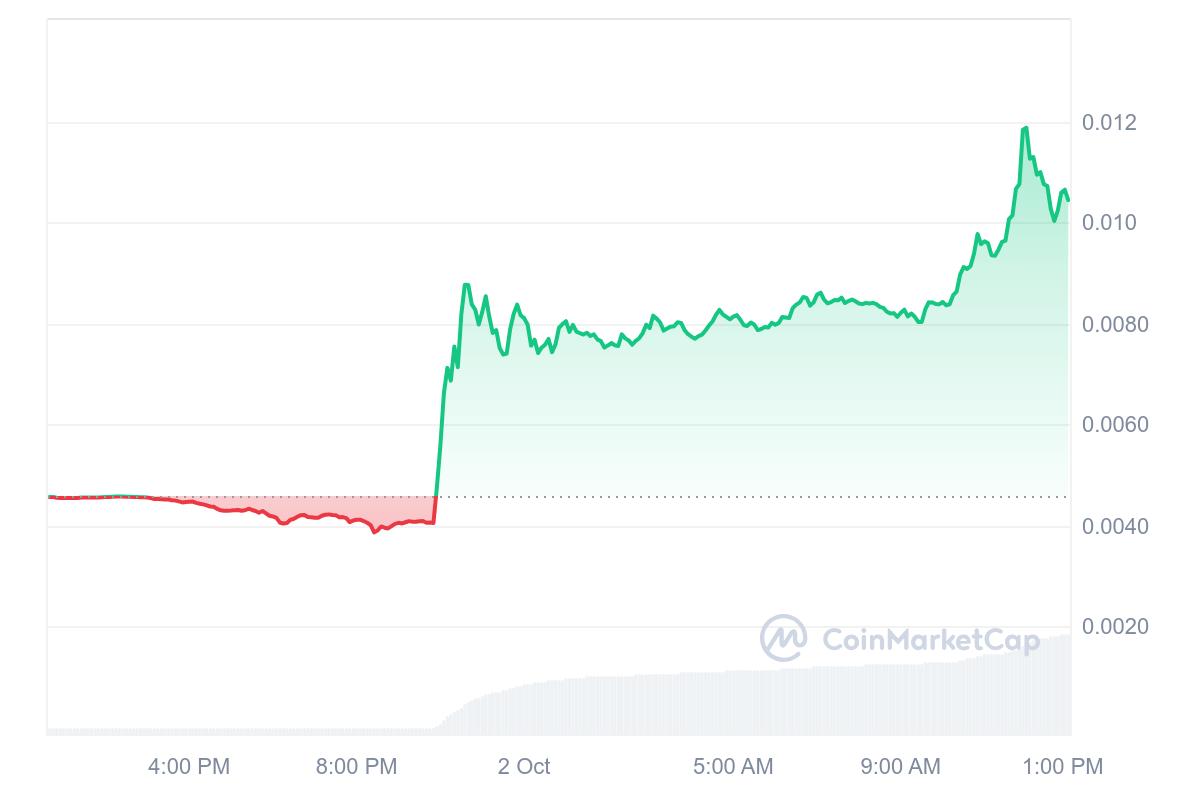

The SHIB project at first was regarded as merely a trial run but ever since it has shown that there is a lot more than meets the eye. For instance, As of today, SHIB costs $0.0000194, with an enormous 24-hour trading volume of $2.06 billion. Even in these figures alone, one may appreciate the level of liquidity and deepening popularity of the token. In the last 7 days and the last 30 days, the SHIB growth performance has grown by 34.73% and 36.04%, as accompanied by making a bullish continuity more visible. With a Circulating Supply of 589.26 trillion tokens with a market capitalization of $11.48 Billion, SHIB is positioned as one of the most interesting tokens in the market. As a result of the price increase, those investors with the speculative mind that SHIB will increase in value by up to 1,500% saw the opening with this being the best time.

Rexas Finance (RXS): The new defi star on the rise

Although Shiba Inu remains strong in the market, Rexas Finance (RXS) is confidently growing strong in the DeFi space. During the presale stages, RXS went very well and attracted many investors who wanted to invest at early stages in what could be a major project. It is worth noting that the current price for the token is $0.05 since it is at the third stage of its presale. The project presale has attracted more than $1.85 million. With Stage 3 nearly sold out at over 70%, it’s evident that Rexas Finance has caught the attention of investors like never before.

Rexas Finance’s growth

Rexas Finance is positioning itself as the only DeFi platform that provides safe, clear, and effective financial services. With a successful presale, there is already some demonstrated interest on the part of both retail and institutional audiences in the project. Anyone registered on the platform can already earn on their crypto assets by utilizing advanced features such as yield farming, staking, and liquidity mining.

At the same time, Réxas Finance flaunts a solid governance structure as well, which enables all the holders of the tokens to participate in the governance of the platform. Potential ROI is one of the most interesting features when it comes to the RXS token. Market research indicates that investors could enjoy a 4x return before the token gets launched. Looking at the presale price of $0.05, it implies it will be $0.20 or more after launch.

This candidate is perfect for all those who plan to make quite good profits. Besides, there is the $1 million giveaway with 20 people taking home $50,000. To date, over 85,000 people have already contributed to this number and only 125 days remain in the battle.

Is now the right time to buy?

With SHIB gathering considerable appreciation as is with RXS, the question on everyone’s lips is, is it a good time to buy? In the case of the Shiba Inu token, the upward price movements, expanding market, and hot community stand to reason its upward trend might be rather persistent, more so if the wider market stays positive. This however does not excuse SHIB’s erratic fluctuation, and caution is advised for investors looking to buy in at the top. In contrast, Rexas Finance provides a more traditional subsidized opportunity with its successive presale and clear future outlook. It is positioned well as an ideal project for early backers due to its focus on DeFi and its highly interactive community. The attractive presale fee and promises of 4x returns are enough to help it seek the interest of growth-oriented investors.

Conclusion

Like many other investors, it is worth having a closer look at Shiba Inu and Rexas Finance due to the peculiarities these two have. If you are on the hunt for a well-established token that has millions of followers or you want an emerging star in the DeFi market that has a massive promise, this might be the time to think of investing in these assets.

For more information about Rexas Finance (RXS) visit the links below:

Website: https://rexas.com

Win $1 Million Giveaway: https://bit.ly/Rexas1M

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance

The post Shiba Inu and Rexas Finance grab eyeballs with strong performances, is now still a good time to buy? appeared first on CoinJournal.

from CoinJournal: Latest Crypto News, Altcoin News and Cryptocurrency Comparison https://ift.tt/hQpk2xy