- Sui (SUI) has surged 116.2% in three months.

- While Bitcoin Dogs (0DOG) has seen a considerable decline since its public listing, key metrics point to a possible trend reveal.

- Both tokens show growth potential, with SUI’s TVL exceeding $1 billion and rising interest.

Cryptocurrency investors are continuously on the lookout for promising assets that offer significant growth potential and two tokens, Sui (SUI) and Bitcoin Dogs (0DOG), have caught the attention of investors.

Both Sui and Bitcoin Dogs have showcased impressive performance and unique features, making them appealing choices for traders and long-term investors.

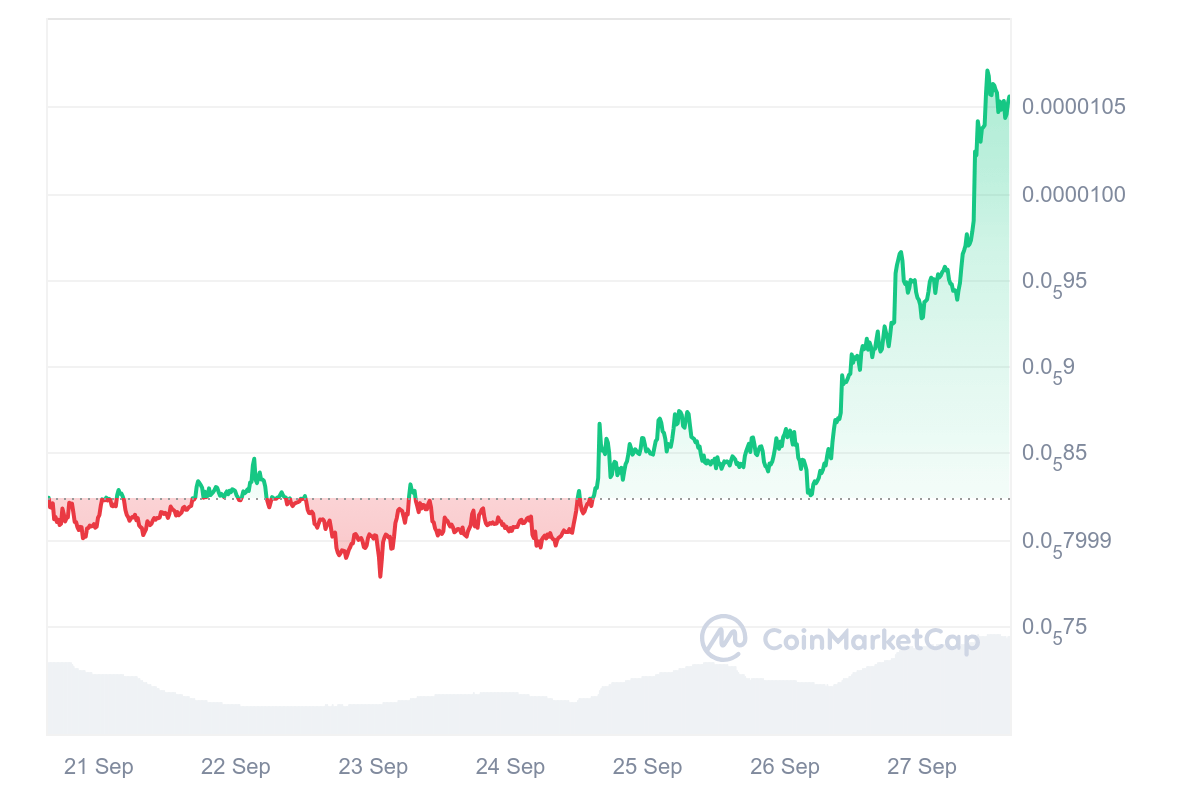

Sui price soars by 63% in two weeks amid bullish market sentiment

Sui (SUI) has recently made headlines, witnessing a remarkable price increase of over 116.2% in the past three months, outpacing established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

Currently priced at around $1.77, SUI has demonstrated resilience despite a recent price pullback, suggesting a robust bullish sentiment. Its price has risen by 63.7% over the past two weeks adding to its yearly gains of 277.09%, at press time.

Sui’s TVL recently surpassed the significant milestone of $1 billion, hitting an all-time high of $1.03 billion on September 19. Although the TVL has slightly decreased to approximately $984.85 million according to DefiLlama, this figure still represents a substantial increase from previous metrics, showcasing the growing liquidity and trust in Sui’s decentralized finance (DeFi) ecosystem.

A higher TVL generally indicates greater liquidity, making the protocol more attractive to both investors and developers.

Sui’s trading volume also reflects strong market confidence, with recent spikes reaching over $1 billion, indicating sustained investor interest. The derivatives market mirrors this trend, with volumes reaching $2.49 billion on September 25, a notable 35.57% increase within just 24 hours.

Despite some fluctuations, these figures underscore a high level of participation in the SUI derivatives market, with significant short liquidations suggesting that bearish traders are being squeezed out, paving the way for continued bullish momentum.

In addition to impressive financial metrics, Sui has seen a rise in user engagement, with daily active addresses increasing from 1.24 million to 1.8 million on September 27—a 12.93% uptick in just one day. This surge in user participation signals heightened interest in Sui’s decentralized applications (dApps) and services, which could further enhance the asset’s attractiveness.

Bitcoin Dogs (0DOG): The Rising Meme Coin

Besides Sui, Bitcoin Dogs (0DOG), a relatively new meme coin, is rapidly establishing itself in the meme coin sector. It is currently priced at $0.00661 after a successful presale round and listing on several crypto exchanges including MEXC.

Although 0DOG has experienced notable volatility, including a 64.83% decline over the past month, its long-term prospects remain bullish. This is largely due to its close correlation with Bitcoin’s price movements, positioning it as a leveraged play on Bitcoin, especially as institutional interest in Bitcoin ETFs grows.

What sets Bitcoin Dogs apart is its innovative approach. As the first-ever ICO project on the Bitcoin network, it combines elements of NFTs and play-to-earn (P2E) gaming mechanics. The upcoming launch of its Telegram game is anticipated to provide additional utility, attracting not only meme coin enthusiasts but also gamers and investors looking for innovative blockchain projects.

This unique blend of features positions Bitcoin Dogs as more than just another meme coin; it represents a new frontier in the Bitcoin ecosystem.

Despite recent fluctuations, Bitcoin Dogs has the potential to outperform traditional assets in bullish market conditions.

Analysts predict that the meme coin supercycle is just beginning, with 0DOG expected to capitalize on this trend. Early Bitcoin investors, who have demonstrated market-savvy decisions in the past, are flocking to Bitcoin Dogs, hoping to replicate their initial successes with Bitcoin.

Conclusion

With both Sui and Bitcoin Dogs capturing investor attention through their unique value propositions and strong metrics, they are set to play significant roles in the evolving cryptocurrency landscape. As more participants enter the market, these tokens could pave the way for future growth, making them essential assets to watch closely in the coming months.

Whether you are a seasoned trader or a newcomer to cryptocurrency, SUI and 0DOG offer intriguing opportunities for those willing to explore their potential. For more information about 0DOG, you can visit the project’s website.

The post Sui (SUI) and Bitcoin Dogs (0DOG) gains attract investors’ attention appeared first on CoinJournal.

from CoinJournal: Latest Crypto News, Altcoin News and Cryptocurrency Comparison https://ift.tt/BFtS1h8