In the dynamic world of digital currency, several factors affect the values of all digital assets. Some factors include utilities of the crypto, demand & supply, cost of mining, regulation, and media coverage. However, a significant factor that drives crypto’s value is its popularity among people.

The fundamental aim of all crypto projects is wide acceptance. All project owners wish to reach a large number of people globally. And most of the crypto projects in the coin market today gain popularity through a series of endorsements from celebrities worldwide.

This article will explore the influence of celebrity endorsement on digital assets. We will also discuss its ripple effect in casinos like Bitcoin live casino and other platforms.

Influence of Celebrity endorsement on crypto

Celebrities are public figures with large fan bases from around the world. They are influencers that control a large amount of crowd due to their integrity, credibility, or crafts. These celebrities include musicians, athletes, philanthropists, actors, actresses, etc.

Crypto agents often engage some renowned individuals to draw more attention to their projects. Some celebrities often publicize the project out of love for the particular crypto. They leverage the volume of fans that trust and love them to put more spotlight on the asset and increase its value.

Elon Musk and Dogecoin

A prime example of a celebrity influencing token value is the impact of Elon Musk on Dogecoin. Elon Musk owns several multinational corporations such as Tesla, SpaceX, Neuralink, and Twitter. According to a recent ranking by Forbes in August 2023, he is also the wealthiest man in the world.

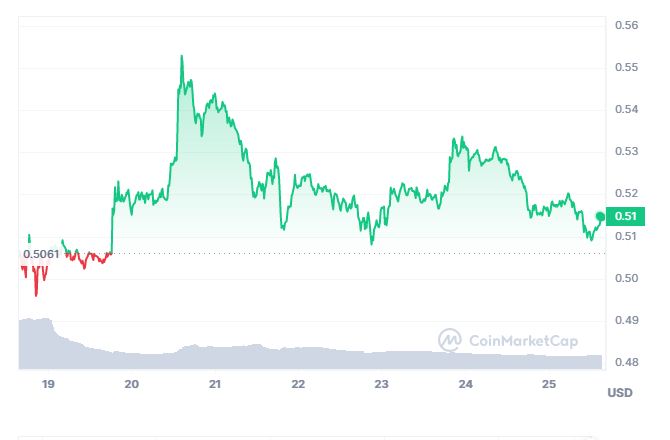

Elon frequently mentions Dogecoin on Twitter, his social media account with millions of followers. For instance, in May 2021, he tweeted about Dogecoin light-heartedly. This tweet led to a 20% leap in the Doge’s value to attain its all-time highest price.

Also, in December 2021, Elon Musk announced that Tesla would start accepting Dogecoin as a means of payment. Dogecoin’s value increased by 40% after this announcement.

Conversely, when Elon tweets negatively about the digital currency, its value drops; for example, in May 2022, he tweeted that he would sell most of his physical possessions to hold Bitcoin and Ethereum without mentioning Dogecoin. This tweet leads to a decline in the value of digital assets by 30%.

However, Elon’s mention of Dogecoin in its tweets has made the project popular globally. The coin is now among the top 10 most valuable digital assets in the coin market.

These activities show that the influence of celebrities like Musk has a direct impact on a token’s value. This effect can extend to the world of casinos and increase their popularity among gamblers.

How Celebrity endorsement will influence Bitcoin Live Casinos

As digital assets gain popularity, their use cases expand. Beyond portfolio investment, they become viable as payment methods. This shift is reflected in Bitcoin live casinos, which incorporate these tokens into their payment systems.

Celebrity endorsements of tokens create a buzz that extends to casino platforms. This results in a surge of new players at Bitcoin live casinos, particularly among the fans of those celebrities who also enjoy gambling. This surge in new players enhances user engagement and drives the platform’s growth.

Furthermore, these endorsements contribute to building trust within the casino industry. They legitimize the platforms in the eyes of the public, as people feel confident using tokens that their favorite artists endorse.

For online casinos to fully leverage the spotlight brought by celebrity endorsements, they must generously reward new players. This involves crafting exclusive offers like registration bonuses and other enticing rewards to captivate new users.

Exciting Game Experiences

Casinos should also curate distinctive gaming experiences. This may involve hosting exclusive tournaments and innovative promotional campaigns. Overall, such activities should give out rewards to participants. When players are content with their casino experience, they’re more likely to become repeat customers, fostering the casino’s growth.

An intriguing perk of celebrity-endorsed tokens for gamblers is the potential for increased winnings upon cashing out. As mentioned earlier, when celebrities back a digital asset, its value often rises.

Consequently, gamblers who win, bet, and withdraw using the endorsed token may see their earnings grow in their digital wallets. This prospect of augmented earnings enhances the appeal of celebrity-endorsed tokens among global gamblers.

However, it’s essential to recognize that celebrity endorsements of digital assets have both pros and cons. A notable downside is the potential for heightened price volatility in the coin market. This volatility can lead to fluctuations in gamblers’ earnings.

One strategy to mitigate such volatility’s impact on earnings is to convert earned tokens into stablecoins. These stablecoins are pegged to physical assets, promoting stability, reducing volatility, enhancing utility, and bolstering liquidity. Examples of stablecoins suitable for swapping earned tokens include USDT, DAI, and USDC.

What are the Challenges and Ethical Considerations

While celebrity endorsements can bring visibility and credibility to Bitcoin live casinos, they also raise important ethical considerations. There is a distinction between genuine endorsement and exploitative behavior.

Critics argue that celebrities endorsing gambling platforms could potentially influence vulnerable audiences. Young fans can also be motivated to gamble without fully understanding the associated risks. However, underage gambling is illegal in different parts of the world.

For casinos to curtail this ethical risk, there should be awareness of the risks associated with gambling. Casinos should also indicate a discretion message on their platform about the minimum age to bet.

Transparency is another crucial aspect. Celebrities must disclose any financial incentives tied to their endorsements, as failing to do so could mislead their followers and potentially violate consumer protection regulations.

Responsible endorsements should emphasize the pros and cons of the coin they support. In addition, Clear guidelines and regulations regarding disclosure and responsible endorsement are vital to prevent potential harm and promote ethical practices.

Conclusion

The influence of celebrity endorsement cannot be understated. It could bring more players to join casinos. However, gamblers should also pay attention to the challenges stated in this article to avoid disappointments.

This is an externally provided sponsored article. Sponsored articles like this may include advertising content and links. The content is not intended as financial advice and is for informational purposes only.

The post Crypto Celebrity Endorsements: Influencers in the Bitcoin Casino Space appeared first on CoinJournal.

from CoinJournal: Latest Bitcoin, Ethereum & Crypto News https://ift.tt/FwU3g1G